Global Environmental Conservation

We work for environmental conservation in order to reduce the impact of our business operations, products and service on environment, and make continuous improvements.

Fundamental Environmental Policy and Environmental Mid-to Long-term Plans

Fundamental Environmental Policy

In recent years, we understand that our stakeholders have become increasingly concern about our environmental issues, including climate-related issues. In such a situation, we believe that we are socially responsible for realizing a low-carbon society and contributing to a recycling-oriented society.

The GS Yuasa Group has established this Fundamental Environmental Policy to outline our basic Group-wide approach to environmental efforts. The policy aims to clarify our social responsibility toward the environment and guide our contributions to the emergence of a sustainable society. We are also developing and using environmental management systems that will help to reduce environmental impacts and prevent any accidents that could cause environmental pollution.

Fundamental Environmental Policy

-

Fundamental Philosophy

We are committed to people, society, and the global environment through the “Innovation and Growth” of our employees and business entities. We will apply the advanced energy technologies we have built up through battery research and development work to deliver comfort and peace of mind to customers around the world, and aim to realize a sustainable society and increase corporate value.

-

Action Guidelines

- Compliance with laws, regulations, and other requirements

We will strive to prevent environmental incidents, comply with legal requirements, and reduce risks connected with the use of chemical substances, and continually improve our environmental management system with the aim of enhancing our environmental performance.

- Reducing environmental burden

We will aim to be carbon neutral by reducing greenhouse gas emissions throughout our supply chain to limit climate change impacts. We will also recognize water as an important resource and strive to conserve it by reducing consumption levels.

- Efficient utilization of natural resources

Toward a circular economy*, we will strive to minimize the amount of natural resources we use through a range of means, including reducing raw material usage, using recycled materials, and reducing waste throughout product life cycles and services.

- Environment-friendly products

To be able continue “creating the future of energy”, we will develop and manufacture products and services that can contribute to the formation of a carbon-neutral circular economy.

- Biodiversity

Given that our business activities, products, and services depend on the natural environment, we will promote biodiversity conservation activities to protect the ecosystems of endangered and rare species.

- Disclosure

We will disclose environment-related information to stakeholders in an appropriate manner, and strive to coexist harmoniously with communities by engaging in proactive communication.

- Human resources development

We will foster, across the entire GS Yuasa Group, personnel able to forge the future of our business with the aim of meeting our responsibilities in helping to create a carbon-neutral circular economy.

Resource recycling society with zero waste

- Compliance with laws, regulations, and other requirements

Environmental Mid- to Long-term Plans

We have developed mid-term plans for important issues related to our fundamental environmental policy in order to contribute to the emergence of a sustainable society. Since fiscal 2019 we have been promoting this as one of our business strategies to address key management issues that concern the entire Group by incorporating environmental objectives into our Mid-term Management Plan.

In April 2023, the GS Yuasa Group announced our Carbon Neutrality Declaration in the pursuit of reaching zero CO2 emissions (Scope 1 and Scope 2) from our business activities by fiscal 2050. As specific milestones for achieving our Carbon Neutrality Declaration, we have set CO2 emission reduction targets through fiscal 2030 and CO2 emission reduction targets in our Mid-term Management Plan. Going forward, the Group will continue to actively promote initiatives to mitigate climate change (energy conservation activities, use of renewable energy, etc.) with the aim of achieving carbon neutrality.

Reviewing the Scope of Application in our Environmental Mid- to Long-term Plans

In order to reliably promote our initiatives for achieving carbon neutrality, we have reviewed the companies subject to our medium- to long-term environmental plans so that we can exert appropriate control and concentrate our management resources within the Group. In addition, CO2 emission conversion factors for Scope 2 have also been changed to improve the suitability of greenhouse gas emission calculation results.

The reviewed scope of application (hereinafter "new standards”) has been enforced since fiscal 2022; however, since the medium-term environmental goals within our Fifth Mid-Term Management Plan which ended in fiscal 2022 had been set under the scope of application before this review (hereinafter “old standards,” the calculation results found through the old standards were used to evaluate the goal achievement status. Regarding the medium- to long-term environmental goals in our Sixth Mid-Term Management Plan, starting from fiscal 2023, we will continue to contribute to the realization of a sustainable society by promoting effective action plans for Group companies under the new standards.

Please scroll sideways

Review of Scope of Application in our Environmental Mid- to Long-term Plans

| Scope of application | Old standards (prior to review) | New standards (after review) | Remarks | |

|---|---|---|---|---|

| Scope | Group companies with key production sites (7 domestic plants, 20 overseas companies) | Consolidated target companies with production sites for which annual CO2 emissions of 1,000 tons or more (8 domestic plants, 16 overseas companies) | New standards include production sites with CO2 emissions under 1,000 tons that are expecting increased emissions in the future | |

| CO2 emission conversion factors for scope 2 | Domestic | Factors for fiscal 2016 released by the Electric Power Council for a Low Carbon Society | Factors for each fiscal year released by each electric power company in accordance with the Act on Promotion of Global Warming Countermeasures | CO2 emission conversion factors related to the usage of renewable energy derived electric power is set at zero |

| Overseas | Factors of each country released by GHG Protocol | Factors of each fiscal year issued in “Emissions Factors” by the IEA (International Energy Agency) | ||

Achievement status of Medium-term environmental goals in the Fifth Mid-Term Management Plan (FY 2019-2022)

Please scroll sideways

| Items | FY 2022 | ||

|---|---|---|---|

| Objectives | Results (Old standards) |

Results (New standards) |

|

| CO2 emission reduction rate (compared to fiscal 2018) | 6.0% or more | 14.8% | 19.8% |

| Water consumption reduction rate (compared to fiscal 2018) | 8.0% or more | 15.6% | 18.5% |

| Percentage of environmentally considered products in total sales of all products |

35.0% or more | 36.4% | 36.4% |

| Ratio of recycled lead used as lead raw materials in lead-acid batteries |

35.0% or more | 52.9% | 58.7% |

The CO2 emission reduction rate for FY2022 under the new standard is calculated using greenhouse gas emission data verified by a third-party organization.

Medium-term environmental goals and Long-term environmental goals (FY 2030) in the Sixth Mid-Term Management Plan (FY 2023-2025)

Please scroll sideways

| Items | Medium-term goals (FY 2025) |

Long-term goals (FY 2030) |

Results for the base year (FY 2018) |

Remarks |

|---|---|---|---|---|

| CO2 emission reduction rate (compared to fiscal 2018) | 15.0% or more | 30.0% or more | 434,360t-CO2 | Organizational boundary (Scope of application): financial control criteria adopted (not applicable to sales companies and sales offices); percentage of emissions based on reduction target of company: 100% |

| Water consumption reduction rate (compared to fiscal 2018) | 15.0% or more | --- | 5,626,133m3 | |

| Percentage of environmentally considered products in total sales of all products | 45.0% or more | --- | (31.9%) | |

| Ratio of recycled lead used as lead raw materials in lead-acid batteries | 70.0% or more | --- | (34.8%) | Ratio of utilization of recycled materials in main products |

The scope of application in this table reflects new standards (Scope: Eight domestic business sites, 16 overseas business companies)

Environmental Management Systems

Operation of environmental management systems

At GS Yuasa Group, we are developing and using environmental management systems that comply with the ISO 14001 international standard.

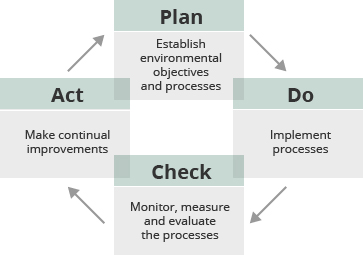

At every site, we use a PDCA (Plan, Do, Check, Act) cycle as part of a systematic framework for environmental management, enabling us to make continual improvements for environmental conservation.

PDCA Cycle

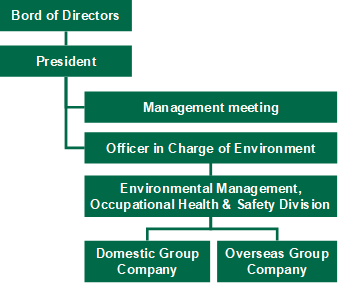

Organizational Structure

In the organizational structure for GS Yuasa Group's environmental management systems, the president of GS Yuasa serves as the chief executive officer responsible for environmental management, overseeing the environmental management of the entire Group working with officers in charge of environment under direct supervision. Environmental issues that affect the entire Group, such as fundamental environmental policy, are discussed and finalized at management meetings.

We are also establishing environmental management systems for domestic business sites and overseas Group companies to enable quick and efficient communication within the group. Starting in fiscal 2018, we are expanding the scope of ISO 14001 certification, the international standard for environmental management systems, from our main domestic business sites to the entire Group, thereby building a system for strategically achieving the Group's environmental goals.

- ISO certification acquisition rate at domestic and overseas production sites

- 100%

Production sites having acquired third-party certification for their environmental management system standards other than ISO 14001 are excluded

Overview of Organizational Structure

Environmental Auditing

We conduct internal environmental audits at every GS Yuasa Group business site to determine whether our environmental policy is being implemented appropriately and that environmental objectives are being met. In addition, we evaluate the environmental management system to improve performance as well as to improve the system itself. We also have an environmental certification agency conduct external environmental audits to check the conformity and effects of our environmental management systems.

Internal environmental auditing

Internal environmental auditors — with qualifications gained from training both inside and outside the company — determine the condition of the following:

- Compliance with environmental laws and regulations, etc. (legal compliance audit)

- Maintenance and management of environmental management systems (system audit)

- Degree of achievement of environmental objectives (performance audit)

External environmental auditing

Audits of the status of maintenance and management for environmental management systems based on ISO 14001 standards and the functioning of PDCA cycles confirmed that every organization subject to audit adheres to ISO 14001 standards. We will continue working to improve these systems by evaluating environmental management from a third-party perspective and by using information on such items as areas needing improvement.

Environmental Education

The GS Yuasa Group employs different types of environmental education to maintain and improve environmental management systems. In addition, we regularly provide training to avoid exposure to environmental risk.

General Environmental Education

| Education for Employees | In every division, we provide education to all employees to build awareness of their role in achieving the environmental policy. |

|---|---|

| Education for new recruits | New recruits are made aware of the GS Yuasa Group's basic philosophy on environmental management. |

Specialized Environmental Education

| Training of internal environmental auditors | At every business location, we train internal environmental auditors and provide them with education to boost their skills to continually improve our environmental management systems. |

|---|---|

| Emergency response training | In every division, we regularly provide training on responses to potential emergencies to all employees working in operations that have significant potential impact on the environment. |

Environmental Compliance Management

The GS Yuasa Group regularly reviews the environmental laws and regulations that must be obeyed, and ensures, through monitoring, that operations are managed in a way that is legally compliant.

Further, business is conducted in compliance with environmental laws and regulations since we use hazardous substances, such as lead, in our products and we must obey the laws and regulations related to the operation of recycling systems for used products.

There was no litigation and there were no punitive fines or administrative fines for nonadherence to environmental laws or regulations in fiscal 2022.

Environmental Risk Management

Our GS Yuasa Group develops environmental risk management with consideration to the different needs of our stakeholders. In every business location, we work to prevent environmental pollution (atmospheric pollution, water contamination, etc.) through operational management based on voluntary standards that are stricter than regulatory standards based on environmental laws, regional ordinances and agreements.

In operations that have significant potential impact on the environment, we implement both tangible and intangible measures to reduce the risk of pollution. The tangible measures include: increasing the visibility of operations, preventing spills and using equipment to remove noxious substances. Intangible measures include: equipment inspections, monitoring, measuring and enhancing of operational procedures.

We also hold emergency response training regularly to help mitigate damage in an emergency situation.

In fiscal 2022 there were no instances of emergencies directly related to environmental pollution at any of our business locations.

Appropriate Environmental Information Disclosure

The Group conducts environmental information disclosure in response to the CDP*1. The CDP requires companies to disclose information of environmental strategies based on the needs of institutional investors and customers. As we recognize that climate-related issues are one of the important management issues, we are working on climate-related information disclosure based on the TCFD*2 framework.

For the volume of greenhouse gas emissions (including energy consumption), we disclose information for which authenticity of data has been secured through third-party verification*3. We are also promoting disclosure of information on water security performance and countermeasures with regards to water risks.

In the future as well, we are committed to working on disclosure of appropriate environmental information in response to the needs of various stakeholders.

1This is a global-standard information disclosure platform for corporate initiatives to address environmental issues (climate change, water security etc.), with an established mechanism in which scores calculated based on corporate information disclosure are used for evaluation by investors and others.

2An organization established by the Financial Stability Board at the request of G20 for examining climate-related information disclosure and ways in which financial institutions can respond

3We have received third-party verification from SGS Japan Inc. (Scope 2 verification data: CO2 emissions calculated based on market standards)

Statement on third-party verification (FY 2022)Refer here for information on our initiatives for the TCFD

Activity to Decrease Environmental Burdens

Designing environmentally conscious products

The GS Yuasa Group's products have some impact on the environment during every stage of the product life cycle, from procurement and manufacturing to transportation, use and disposal. In order to reduce the environmental burden throughout the product life-cycle caused by the consumption of resources and the generation of greenhouse gases and waste, the Group is committed to improving the product performance through designing that considers selection of raw materials, ease of disassembly and segregation, energy conservation, and appropriate labelling.

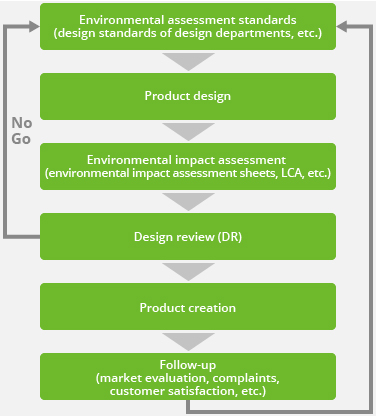

For an environmental assessment of product design, design departments employ design standards and then evaluate the suitability of products in design review (DR) meetings based on environmental impact assessments of every stage of the product life cycle. When environmental impact standards are not met, we review the design standards and redesign the product. We use the expertise of several departments in addition to design departments, including engineering, marketing, procurement, quality and the environment, to make sure that the results of Design for the Environment (DfE) are communicated widely, which also maximizes their effectiveness.

Environmental Assessment Items

- Energy conservation

- Volume reduction

- Recyclability

- Ease of disassembly

- Ease of separation processing

- Safety and environmental conservation

- Material selection

- Ease of maintenance

- Energy efficiency

- Reusability (life extension)

Flow of Environmental Assessment

Reflecting information in the products we distribute

Important information, such as customer requirements for GS Yuasa Group products, is used when we change the design of existing products or design new products. This helps boost the value of our Design for the Environment. Information from interested parties related to after-sales service, returns and complaints are used as a valuable resource to improve the environmental performance of products.

Management of chemical substances contained in products

The GS Yuasa Group takes steps to provide products with minimal environmental burden based on the Chemical Substance Management Guidelines, which clarify the standards for chemical substances in products. These guidelines are part of initiatives to examine chemical substances contained in materials delivered as stipulated in the GS Yuasa Group green procurement criteria. With these guidelines, we classify chemicals contained in our main materials, as well as the secondary materials and the parts used in the products that the Group makes and sells as either prohibited substances or managed substances. The GS Yuasa Group works with our suppliers who supply main materials, auxiliary materials and components to identify and definitively manage the substances covered by the guidelines to raise the environmental quality of our products.

Popularizing environmentally considered products

The GS Yuasa Group defines environmentally considered products as those products that help mitigate global warming, and we are actively working to develop and popularize such products. We incorporate into the Group's Mid-Term Management Plan sales targets for environmentally considered products, making it part of our business strategy to work on climate change through the products we provide to customers.

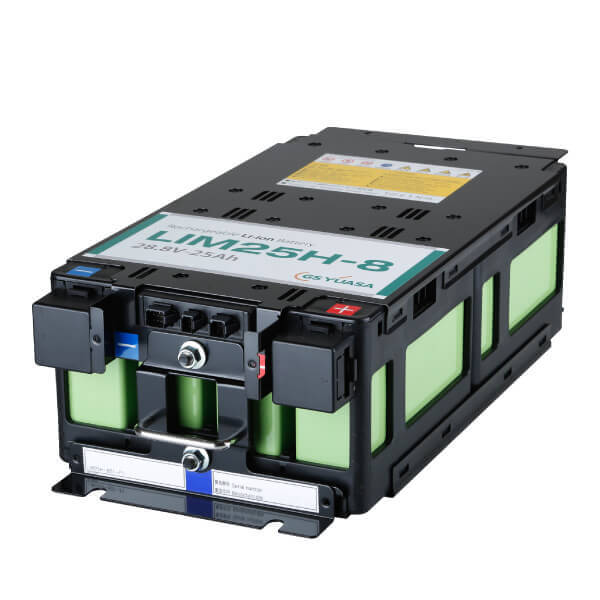

Examples of Environmentally Considered Products

| Item | Description | Examples of products |

|---|---|---|

| Batteries for vehicles with start-stop systems | Batteries for vehicles with start-stop systems (ISS) for improving gas mileage by allowing the engine to stop instead of idling to reduce fuel consumption | |

| Storage battery system | A system to effectively utilize renewable energy (power conditioners, lithium-ion battery, etc.) | |

| Automotive Lithium-ion Batteries | Hybrid vehicle batteries and electric vehicle batteries that contribute significantly to reducing greenhouse gases |

Click image to enlarge

Increasing Usage Rate of Recycled Lead in Products

The GS Yuasa Group is working to increase the usage rate of recycled lead—the primary material used in lead-acid batteries, one of our core products. We take action to work toward a recycling-oriented society as part of our business strategy by incorporating into the Group's Mid-Term Management Plan targets for the usage rate of recycled lead contained in our lead-acid batteries.

The GS Yuasa Group has been taking action to recycle our post-use products by building and operating a recycling system based on extended producer responsibility (EPR). Going forward, we also plan to strengthen our efforts to promote the use of recycled materials in our products.

Reduction of CO2 Emissions by Promoting Group-wide Energy Management

The GS Yuasa Group believes that it is important to continuously improve the energy management system associated with its business activities and promotes the reduction of greenhouse gas emissions in order to respond to the social changes accompanying the transition to a decarbonized society (such as requests from stakeholders to reduce greenhouse gas emissions, addition of carbon prices to the use of fossil fuels, and shift from fossil fuels to renewable energy).

In fiscal 2023, the GS Yuasa Group established an organization dedicated to promoting group-wide energy management in order to achieve our Carbon Neutrality Declaration targeted at fiscal 2050 and our long-term environmental goals (30% or greater reduction of CO2 emissions by fiscal 2030 compared to fiscal 2018*). This organization promotes activities to formulate specific action plans for business divisions in order to continuously engage in company-wide project activities (promoting measures to save energy, introducing solar power generation systems in our own factories, and procuring renewable energy) carried out in fiscal 2021 and fiscal 2022.

The Group will continue to promote effective use of energy resources by minimizing energy consumption in conjunction with business activities and using energy-saving technologies and renewable energy and will promote initiatives to realize carbon neutrality in order to fulfill the role of the company in the transition to a sustainable decarbonized society.

The Group manages CO2 emissions in totality and not on a basis of intensity, with the aim of reducing greenhouse gas emissions consistent with the Paris Agreement.

Main Activities of the Energy Saving and Renewable Energy Project (Fiscal 2022)

Please scroll sideways

| Classification | Items | Main Initiatives |

|---|---|---|

| Promoting measures to save energy | Review of facility renewal standards | Formulate an effective facility renewal plan (utilization of facility management ledger) |

| Improvement of production processes | ●Improvement of storage battery charging process, ●Examining for improvement of charging facilities | |

| Efficient use of production facilities | Thorough periodic inspections of capacity utilization status | |

| Introduction of solar power generation facility in our own factories | Implementation of and examining for the plan to introduce solar power generation facility | ●Installed a solar power generation system at the Ritto plant (rating capacity: 2.2MW; estimated reduction: 700t-CO2/year), ●Examining for the introduction of mega solar power generation facility at business sites and Group companies in Japan |

| Survey on the introduction of solar power generation facility | Survey the feasibility of introducing equipment at all 11 business sites and Group companies in Japan | |

| Procuring renewable energy | Procuring electricity derived from renewable energy | Switching to 100% renewable energy for electricity used at the Kyoto Plant (procured 100 GWh equivalent per year from November 2021; fiscal 2022 reduction volume: 28,612t-CO2) |

| Procurement of electricity through renewable energy certificates | Acquisition of domestic and overseas renewable energy certificates (20GWh equivalent; fiscal 2022 reduction volume: 9,250t-CO2) |

Usage Status of Renewable Energy at Our Factories (Fiscal 2022)

Please scroll sideways

| Country | Production site | Classification | Electric power (MWh) |

|---|---|---|---|

| Japan | GS Yuasa International Ltd. (Kyoto Plants) | In-house power generation | 110 |

| External procurement | 92,001 | ||

| GS Yuasa International Ltd. (Osadano Plants) | External procurement | 304 | |

| GS Yuasa International Ltd. (Ritto Plants) | In-house power generation | 377 | |

| GS Yuasa Ibaraki Co., Ltd. | External procurement | 2,555 | |

| United Kingdom | GS Yuasa Battery Manufacturing UK Limited | External procurement | 856 |

| Thailand | Siam GS Battery Co., Ltd. | In-house power generation | 1,569 |

| Yuasa Battery (Thailand) Pub. Co., Ltd. | In-house power generation | 2 | |

| GS Yuasa Siam Industry Ltd. | In-house power generation | 1,231 | |

| Vietnam | GS Battery Vietnam Co., Ltd. | In-house power generation | 156 |

The renewable energy utilization rate for electricity used at our factories is 16.6%.

TOPICS

Introducing a Solar Power Generation System at Our Ritto Plant

The GS Yuasa Group is actively promoting the utilization of renewable energy to achieve our Carbon Neutrality Declaration and long-term environmental goals. In fiscal 2022, we installed a solar power generation system (generation capacity: 2.2 MW, battery capacity: 35.3 kWh) with a stationary power storage system at our Ritto Plant, and it has been in operation since January 2023. The power generated by this system will be used for production activities at our plant. This system is expected to generate approximately 2,300 MWh/year and reduce CO2 emissions by approximately 700 tons/year. We will continue to promote the utilization of renewable energy, including the introduction of mega solar power systems from fiscal 2023 onwards.

Solar power generation equipment (Ritto Plant)

TOPICS

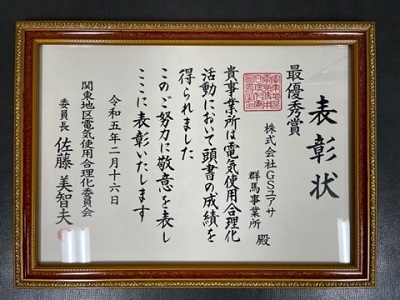

Energy Conservation Activities at Our Gunma Plant

The GS Yuasa Group has continued to promote initiatives for the rational utilization of energy in order to reduce greenhouse gas emissions. The Gunma Plant has engaged in the cyclic utilization of hot air emitted from electric hot-air generators used in the battery manufacturing process. These activities are expected to reduce electric power consumption by 28.2% (15 tons of CO2 emission reductions per year) compared to previous levels. Also, these activities received the highest award in fiscal 2022, the “Energy Conservation Grand Prize,” which is awarded by the Kanto Electricity Use Rationalization Committee* to recognize outstanding energy conservation activities.

Organization established to promote the streamlining of electricity around Japan’s Tokyo Metropolitan Area

Electric hot-air generator

Award certificate

Energy conservation activities for logistics

The GS Yuasa Group promotes energy conservation for freight forwarding (shipping) as one way to reduce the environmental burden during the product life cycle.

As part of coordinated efforts to save energy, we created a system to identify the quantity of goods being shipped, as well as energy consumption and CO2 emissions during logistics. We have established a system to identify the quantity of goods being shipped, as well as energy consumption and CO2 emissions during logistics, and are implementing energy saving measures such as reducing the quantity of items shipped between sites by integration of physical distribution bases and a modal shift from trucks to rail containers and other related systems for transportation.

In addition, the Group has been designated as certified by the Eco Rail Mark System* for three series of batteries for automobiles and motorcycles. By getting customers to purchase certified products, we are promoting activities in which customers and companies can participate together to reduce the burden on the environment.

Our Group promotes logistics that consider the environment by active utilization of rail freight transportation.

A system of certification by the Railway Freight Association, for companies and products that make thorough use of rail transportation for minimal environmental burden.

Examples of GS Yuasa Group products with Eco Rail certification

Initiatives for Water Security

The Group uses a large amount of quality fresh water for applications such as dilution of electrolytes, which are storage battery materials, and cooling of storage batteries in the charging process. Since water resources are important natural resources for the continuation of business activities, we believe it is important to work on ensuring quality freshwater and reducing water consumption. Accordingly, the Group assesses water risks (flooding, drought, water stress, etc.) at production sites using the water risk assessment tools released by the World Resources Institution (WRI) as well as climate-related scenarios and the results of the Company’s own environmental impact assessments. In particular, the water intake volume at production sites determined to have high levels of water stress (four sites located in Turkey, Thailand) is 1,397,749m³, accounting for approximately 30% of total water intake at all production sites. To effectively use limited water resources, including responses to water stress, the Group included targets for reducing water intake in production activities in all countries (15% reduction by fiscal 2025 compared to fiscal 2018) in its Mid-Term Management Plan and is implementing initiatives that are integrated with business strategies. We also respond appropriately to restrictions on water intake imposed by national and local governments.

In addition, in the production process of lead-acid batteries, water containing harmful substances (such as lead) is discharged. The Group recognizes the importance of properly treating wastewater so that such wastewater does not adversely affect the surroundings of our business sites. For this, we are committed to implementing wastewater management based on voluntary management standards that are stricter than regulatory standards, in order to ensure compliance with wastewater standards based on laws and regulations and regional agreements.

By securing water necessary for business activities and through an appropriate response to water risks such as environmental pollution around business sites due to wastewater, the Group aims to promote water security initiatives as well as realize the sustainable use of water resources. Further, we are responding to climate change-related risks based on the TCFD recommendations with respect to risks of damage due to floods (such as the shutdown of our factories due to flooding and disruptions in the supply chain).

Examples of a water risk initiative

Please scroll sideways

| Classification | Items | Main Initiatives |

|---|---|---|

| Water consumption | Reduction of water consumption | Reduction of wasteful use of water by improving manufacturing processes and implementing other measures, introduction of water-saving equipment, recycling of water used in production processes, and education of employees about saving water |

| Treatment of wastewater | Wastewater management | Thorough implementation and management based on voluntary management standards that are stricter than regulatory standards; regular maintenance and management of wastewater treatment facilities |

| Preventing under seepage | Installation of dikes at wastewater treatment facilities and impermeability of floor surfaces | |

| Responding to emergency situations | Establishing response procedures and training for emergency situations in case of water leakage |

Reduction of Water Consumption Associated with Production Activities

The Group promotes the effective use of water by taking measures at production plants such as recycling water and reducing water use.

At lead-acid battery plants, we are undertaking measures to reduce water intake including reusing cooling water, which is used in large volumes during the charging process, and recycling water that has been appropriately treated, such as rainwater and backwash water from industrial water filtration equipment. In addition, by switching the water nozzles of water-cooling devices in the outdoor units of dehumidifiers to spray nozzles at specialized battery factories, we are working to reduce the amount of cooling water used by air conditioning equipment while maintaining the necessary cooling performance.

Preventing Atmospheric Pollution

The Group believes that to prevent any damage to the health and the living environment of local residents, it is crucial to appropriately process substances that are emitted into the atmosphere in the course of our business activities. For this, we are committed to thorough implementation of our environmental management system that conforms to international standards and which ensures that our operations are in compliance with atmospheric emission standards based on laws and regulations concerning soot and smoke, dust, volatile organic compounds, etc. as well as regional agreements. Also, by adopting appropriate measures to prevent atmospheric pollution (installation of dust collectors and maintenance and management of related equipment, etc.), we are making efforts to prevent adverse effects of atmospheric pollution in the vicinity of our business sites. Further, we regularly monitor, and adopt appropriate measures in response to, updated information on atmospheric pollution standards of national and local governments.

Waste Management

The Group considers that promoting effective utilization of resources as well as the 3Rs (reduce: reduce waste generation; reuse; and recycle) are crucial for contributing to the realization of a recycling-oriented society. As lead-acid batteries that constitute the Group's main product use harmful substances (such as lead) as raw materials, we are committed to stressing on the importance of proper disposal of waste generated in our production processes.

By promoting quality improvement activities aimed at reducing in-process defects, the Group ensures reduced waste generation (including hazardous waste). In addition, we are committed to reducing amount of waste generated by reusing raw material loss (such as lead scrap) in the production processes. As for recycling, we are engaged in activities to improve the rate of recycling of resources. We have also established a system to ensure proper disposal of waste in accordance with laws and regulations so as to prevent improper waste disposal (including illegal dumping).

Examples of initiatives for effective use of resources

- Strict implementation of waste separation rules

- Appropriate selection of recycling companies

- Reusing raw materials loss

Examples of operations to ensure proper waste disposal

- Establishing a company-internal system to promote proper waste management

- Strict implementation of waste separation and waste storage rules

- Periodic on-site inspections of waste disposal contractors

- Nurturing personnel in charge of waste disposal practices (including implementation of regular education on waste)

Refer here for data on waste-related changes (amount of recycling, quantity of final disposal)

Recycling Plastic Resources

Since the GS Yuasa Group uses plastics for such things as product materials and packing materials, we recognize the importance of promoting initiatives for the streamlining of plastic resources, which do not easily decompose in the environment, and reducing and recycling waste plastics. The GS Yuasa Group, in the operational management of our environmental management system based on international certification standards, identifies the use and disposal of plastics as key environmental issues and promotes initiatives for recycling plastic resources.

Examples of initiatives for recycling plastic resources

Efficient use of plastic resources and utilization of alternative materials

- Reducing the usage of product packing materials through employing high-elasticity stretch film

- Achieving long-term usage of cushioning materials used for storing semi-finished products through employing highly durable Styrofoam

- Providing products using recycled resin

- Changing resin pallets to cardboard pallets

- Changing plastic cups to paper containers

Reducing waste plastic

- Reusing plastic scraps generated in the production process for product materials

- Reusing plastic materials used in the production process (storage bags, PP band, stretch film, air packs, foam materials, resin pallets)

- Changing from disposable to reusable resin containers

Recycling waste plastic

- Purchasing recyclable office supplies and simple packing supplies (printer ink, label printer cartridges, etc.)

- Thoroughly separating waste plastics (packing materials, PP band, office supplies, food packaging materials, etc.)

- Promoting material recycling for waste plastics (Eco Cap, Styrofoam, etc.)

- Utilizing thermal recycling for waste plastics

Resource Recycling of Used Product

The GS Yuasa Group believes in the importance of creating and operating a system for recycling resources from our used products to help create a recycling-oriented society. To achieve this goal, the Group is promoting initiatives for processing used products and resource recycling by using the wide area certification system.

A wide-area certification system aims to involve the manufacturers of a product in the product's recycling and disposal once it reaches the end of its useful life. These systems make possible more efficient recycling and provide feedback on product design leading to easier disposal and reuse, while ensuring that discarded goods are disposed of properly.

In January 2008, the GS Yuasa Group in Japan acquired wide-area certification from the Ministry of the Environment for industrial batteries and power supplies, and in January 2009 started accepting orders in earnest for a recycling system based on this certification. Even following the start of operations, we continue to make improvements such as expanding the scope of covered products and reviewing operational rules to create mechanisms for the reliable and proper disposal of used industrial batteries.

In the future, we will promote even more effective operation of the wide-area certification system to improve customer service as well as to recycle and properly dispose of post-use products.

Identifying chemical substance emissions

Today, chemical substances used at GS Yuasa group's business sites include those subjects to reporting under the PRTR Law*. The Group incorporates the management of hazardous substances into environmental management and regularly assesses how they have been handled to reduce environmental risk and related legal compliance.

PRTR (Pollutant Release and Transfer Register) Law

This law covers identifying, etc., the emissions of specific chemical substances into the environment and promotes improved management. The law requires businesses to collect, tabulate and disclose data related to hazardous chemical substances, their sources, the amount of emissions and how much is transferred out of the plant, including as waste.

Class I Designated Chemical Substances (substances that may damage people's health or interfere with the growth of animals and plants) are subject to reporting under the PRTR system. Of these substances, those that have carcinogenic properties are classified as Specific Class I Designated Chemical Substances.

TOPICS

Initiatives for Biodiversity

■Kyoto Plant

At our Kyoto Plant, we have participated since fiscal 2021 in the Futaba Aoi Cultivation Program organized by the Afuhi Project located in the premises of the Kamigamo Shrine in Kyoto City, and are involved in the cultivation of the Futaba Aoi, a plant endemic to Japan, in the plant premises. In addition, the cultivated Futaba Aoi plant was handed back to Kamigamo Shrine in April, 2023 and this returned Futaba Aoi will be used for the Aoi Katsura at the Aoi Festival, one of the three major festivals in Kyoto. From next year as well, we plan to our participation in the Afuhi Cultivation Program and are committed to considering and promoting appropriate biodiversity initiatives to which the Group can contribute.

Afuhi Cultivation Program: The cultivation of Futaba Aoi by "Aoi no Mori" located in Kamigamo Shrine is a program to cultivate the Futaba Aoi externally (that is by individuals, companies etc.). This is because there is a high risk of animal damage attributed to deer and moles and abnormal weather, etc. A project that aims for external cultivation of Futaba Aoi (by individuals, companies etc.) to avoid the high risk of animal damage attributed to deer and moles and abnormal weather when the Futaba Aoi is cultivated in the "Aoi no Mori" situated within the premises of the Kamigamo Shrine.

Futaba Aoi

Transplanting the Futaba Aoi

Offering the Futaba Aoi

■GS Yuasa Siam Industry Ltd.

To protect the local ecosystem, GS Yuasa Siam Industry Ltd. (GYSI), an overseas Group company in Thailand, has planted and grows wild almond trees (a native species known locally as the samrong tree/สำโรง) around its factory in an effort to prevent the growth of alien species. This initiative has won high praise from Chachoengsao Province, where GYSI is located, and in fiscal 2023 the company received the Good Governance Environment Promotion Award presented to companies operating in the province that are making efforts toward the realization of a sustainable industry and society.

Planted trees

Recent photo of wild almond tree blossoms

Screening by province personnel

■GS Yuasa Battery Manufacturing UK Limited

GS Yuasa Battery Manufacturing UK Limited (GYMUK), an overseas Group company in the United Kingdom, established a biotope of about 400 m2, with a pond and grassland, in the factory grounds, creating an ecosystem inhabited by various creatures, including birds, fish, and insects. This biotope secured the top place in the Blaenau Gwent in Bloom award from 1988 to 2020, presented to beautiful gardens by the county of Gwent in Wales, where GYMUK operates.

Biotope scenery (pond)

Biotope scenery(stone monument)

Blaenau Gwent in Bloom awards

TOPICS

Environmentally Considered Road Paving

At our Gunma Plant, we have repaved the roads on the premises using asphalt modifiers generated from collected waste plastic bottles. We adopted a method of paving the roads that not only improves the durability of the asphalt pavement but also promotes the effective use of resources. The GS Yuasa Group also promotes initiatives that take environmental impact into consideration for infrastructure improvements on our plant premises.

Environmentally considered road pavement on the premises (Gunma Plant)