The GS Yuasa Group recognizes that climate-related issues are one of our important management issues. In December 2019 we announced our support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), and we are working on climate-related information disclosure based on the TCFD framework.

In fiscal 2021, we launched a project to examine climate-related risks and opportunities in accordance with the TCFD framework. The major scenarios adopted for our analysis of risks and opportunities were the 1.5°C scenario and the stated policies scenario (equivalent to the 3°C scenario). We devised strategies based on the short-term (fiscal 2025), medium-term (fiscal 2030), and long-term (fiscal 2040 and fiscal 2050) time axes.

In fiscal 2023 we disclosed quantitative financial impact assessments for each business for some climate-related risks and opportunities.

*Scroll horizontally to view the entire page.

Governance

GS Yuasa International Ltd., our core operating company, plans and implements responses to climate change in the Group. The company’s Board of Directors supervises the entire Group, receiving regular progress reports from GS Yuasa International Ltd. and providing guidance as necessary.

Policies, targets, and important topics related to the environment are formulated and deliberated upon by the Sustainability Promotion Committee* and reported to the Management Meeting and the Executive Conference, which is headed by the president.

【Governance Structures Relating to Climate Issues】

-

Board of Directors

<Engages in deliberation and discussion at least once every three months>

Approves proposed responses to environmental issues (including climate change),

receives status reports, and monitors and oversees progress

Directors and auditors

-

Management Meeting

<Engages in deliberation and discussion several times annually>

Discusses proposed responses to environmental issues (including climate change)

Directors and auditors

-

Executive Conference

<Meets once every six months>

Receives reports on proposed responses to environmental issues (including climate change) and manages the progress of responses

President, director in charge of the environment , and relevant directors

-

Sustainability Committee

<Engages in deliberation and discussion several times annually>

Deliberates and discusses sustainability management issues and initiatives

Directors and auditors

-

Sustainability Promotion Committee

<Meets once every two months>

Formulates and discusses proposed responses to environmental issues

(including climate change) and manages the progress of responses

Director in charge of sustainability promotion, sustainability promotion managers of each division and each business office

【Examples of past reports and agenda items related to climate change (FY2019–2024)】

| Meeting entity | Topics reported and discussed |

|---|---|

| Board of Directors | Formulation of the Fundamental Environmental Policy |

| Establishment of the GY 2030 Long-Term Greenhouse Gas Targets | |

| Disclosure of business strategies based on the TCFD | |

| Renewable energy procurement policy | |

| Setting of carbon neutrality targets | |

| Management Meeting, Executive Conference, Sustainability Committee and Sustainability Promotion Committee |

Endorsement of TCFD recommendations and membership of the TCFD Consortium |

| Launch of the Energy Saving and Renewable Energy Project to reduce CO2 emissions | |

| Progress report on the Energy Saving and Renewable Energy Project | |

| Introduction of internal carbon pricing (ICP) | |

| Introduction of in-house solar power generation | |

| Formulation of environmental targets in the Sixth Mid-Term Management Plan |

Risk Management

Risks and opportunities are identified and evaluated through the process described below.

-

Identification of risks and opportunities relating to climate pursuant to the TCFD framework;

-

Evaluation of the degree of impact of the identified risks and opportunities using companywide risk management criteria;

-

Identification of significant risks and opportunities for which the degree of impact is particularly large and investigation of responsive measures.

Identified risks and opportunities, and the responses to them, are managed under our governance structures including the Sustainability Promotion Committee.

In fiscal 2021, each business division and management division established a project team to conduct companywide analysis of scenarios and examine countermeasures.

Strategy

Assumed Conditions

【Main Scenarios Used in Scenario Analysis*1】

*Scroll horizontally to view the entire page.

| Temperature increase | Main scenarios used | Overview |

|---|---|---|

| 1.5℃ | IEA*2 Net Zero Emissions by 2050 Scenario (NZE) | A scenario indicating what the world (policies, technologies, markets, etc.) needs to look like in order to achieve net zero global greenhouse gas (GHG) emissions by 2050 (assumed through a backcasting method) |

| IPCC*3 RCP*4 2.6 Scenario and SSP*5 1-2.6 Scenario | RCP2.6: A scenario that assumes future temperature rise to be limited to less than 2°C used in the IPCC Fifth Assessment Report SSP1-2.6: A scenario for the introduction of climate policies to limit future temperature increases to less than 2°C under sustainable development used in the IPCC Sixth Assessment Report |

| 3℃ | IEA Stated Policies Scenario (STEPS) | A scenario based on energy and climate policies previously implemented and individual policies that are currently being implemented by individual governments |

| IPCC RCP 8.5 Scenario and SSP 5-8.5 Scenario | RCP8.5: A scenario with maximum GHG emissions used in the IPCC Fifth Assessment Report SSP5-8.5: A scenario with no climate policies used in the IPCC Sixth Assessment Report |

- Scenario analysis uses the scenarios of public agencies and may differ from actual future social conditions.

- International Energy Agency

- Intergovernmental Panel on Climate Change

- Representative Concentration Pathways

- Shared Socioeconomic Pathways

【Time Axis】

- End year

- Reason for adoption

- Short term

- 2025

- Periods of the Fifth (FY2019–FY2022) and the Sixth (FY2023–FY2025) Mid-Term Management Plans

- Medium term

- 2030

- Achievement period of the GY 2030 Long-Term Greenhouse Gas Targets and SDGs

- Long term

- 2050

- Achievement period of the GY 2050 Carbon Neutrality Target

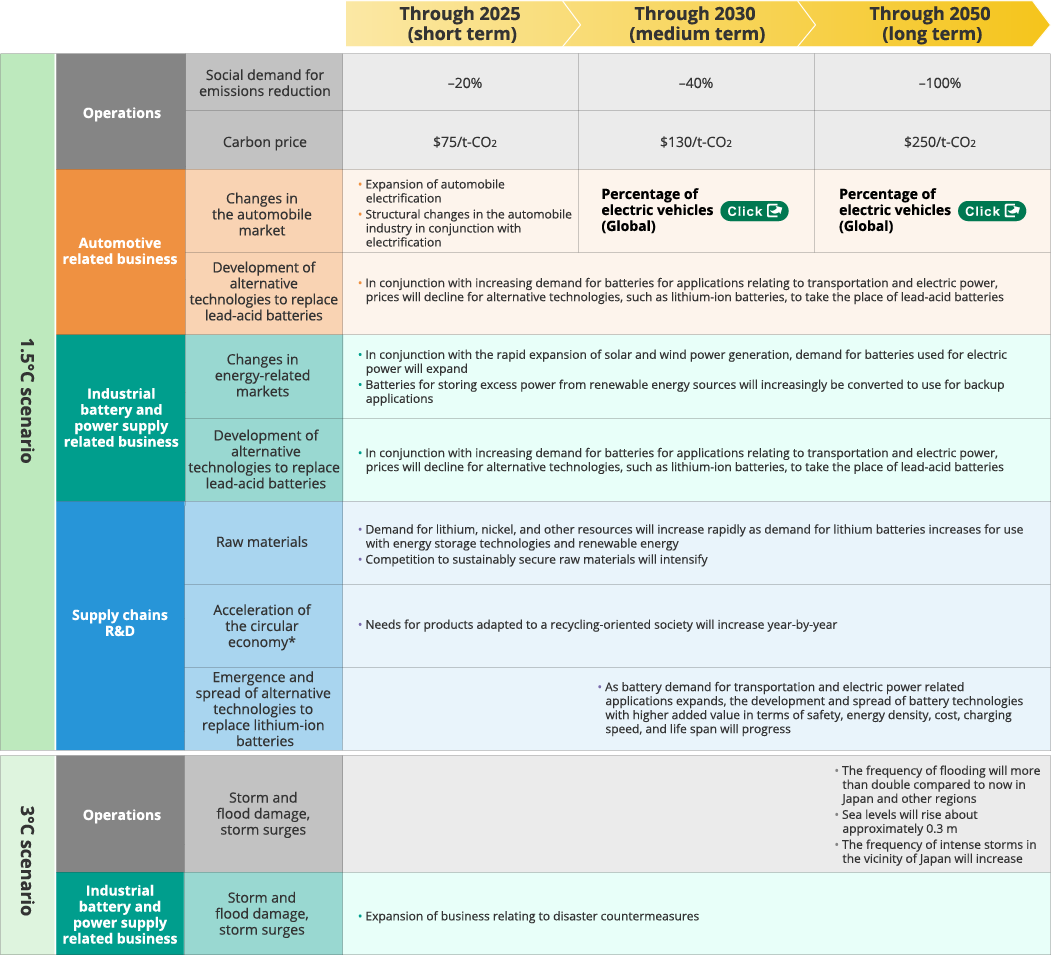

【Social conditions under scenario】

Click the button for details.

*Scroll horizontally to view the entire page.

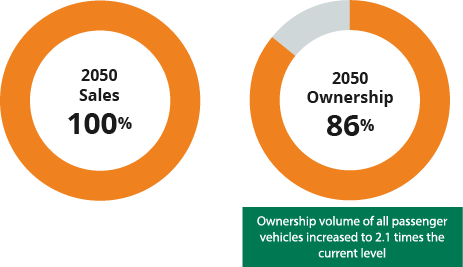

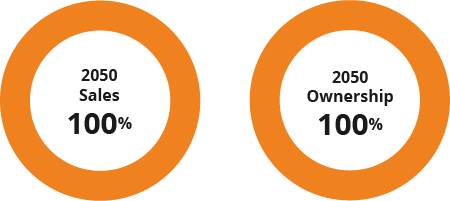

Ratio of EVs, PHEVs, and FCVs in passenger vehicles

Ratio of EVs in two-wheeled and three-wheeled vehicles

Ratio of EVs, PHEVs, and FCVs in passenger vehicles

Ratio of EVs in two-wheeled and three-wheeled vehicles

- EV: Electric Vehicle; PHEV: Plug-in Hybrid Electric Vehicle; FCV: Fuel Cell Vehicle; HEV: Hybrid Electric Vehicle

- Circular economy: An economic mechanism for the circulation of resources without waste. Positioned as a medium- to long-term economic growth policy, particularly in European countries.

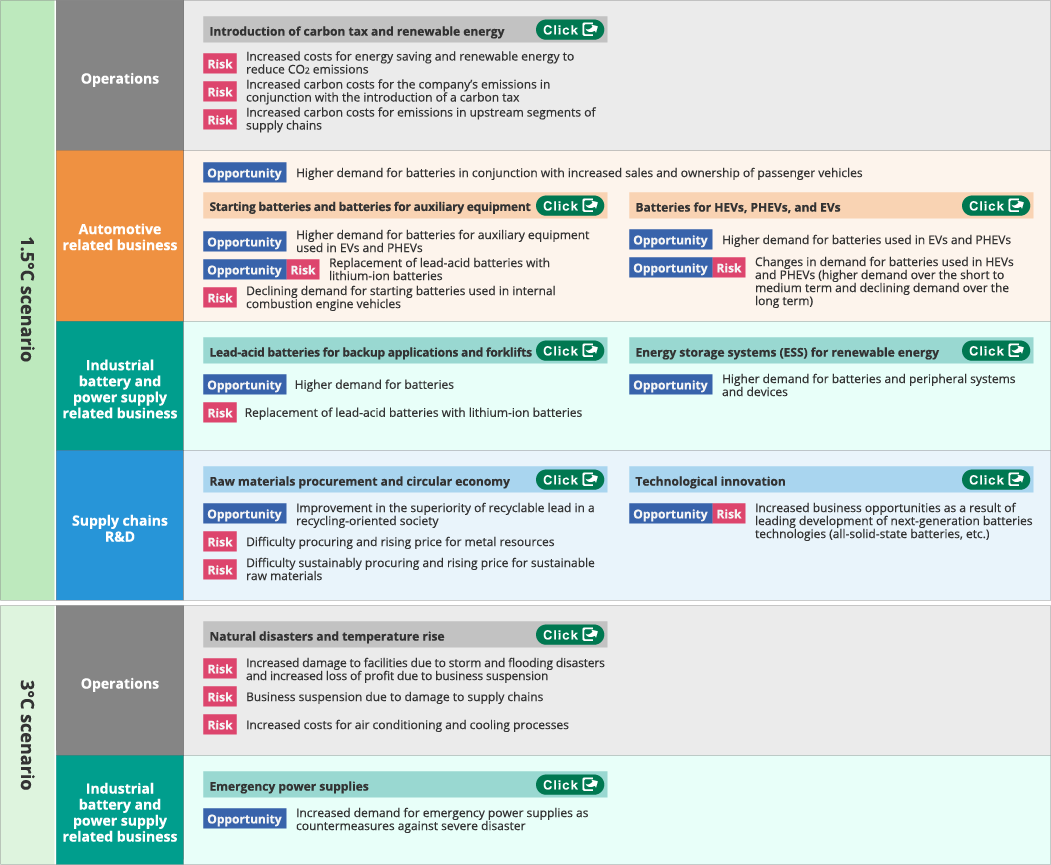

Risks and Opportunities

Click the button for details.

*Scroll horizontally to view the entire page.

In the case of the 1.5°C scenario, targets for a major reduction of CO2 will be required and carbon taxes will be introduced to achieve carbon neutrality. On the other hand, by implementing CO2 reduction measures through the introduction of energy-saving equipment and renewable energy, it will be possible to reduce the carbon tax burden to a certain extent.

Results of a scenario-based estimate of the financial impact indicated a risk that the introduction of a carbon tax will increase costs by about 3–4 billion yen over the medium to long term. By thorough energy saving and the planned introduction of renewables, however, the cost increase could be reduced to about 2 billion yen.

In conjunction with expansion of the market for EVs, PHEVs, and other such vehicles, demand for starting batteries used in internal combustion engine vehicles is expected to decline, but demand for batteries for auxiliary equipment is expected to increase. Also, the shift from a certain number of lead-acid batteries to lithium-ion batteries is expected to advance.

As a result of our estimate of the financial impact, based on the establishment of certain conditions with reference to a scenario-based market, we concluded that while sales of starting batteries will decline sharply, overall sales could increase by 35–55 billion yen over the medium to long term due to a substantial increase in the demand for batteries for auxiliary machinery.

Demand for batteries used in transportation and electric power related applications is expected to increase, but as technological innovation progresses, it is expected that prices for lithium-ion batteries and other such products will fall and that a certain number of lead-acid batteries will be replaced by lithium-ion batteries.

Risks such as rising resource prices and difficult securing resources are expected over the short to medium term. On the other hand, with the development of alternative technologies, it is expected that tight supply and demand situations will be alleviated over the long term. It is also expected that competition relating to sustainable procurement of raw materials will intensify in terms of the environment and society.

There is a risk of greater impact due to increased storm and flooding damage, including property damage to facilities and machinery at the company’s plants, loss of profits from business suspension, and the inability of workers to report to work. The interruption of supply chains is also anticipated.

As a result of an examination of flood and storm surge risks based on future climate change impacts using natural disaster simulations, five sites and subsidiaries (two in Japan and three overseas) were evaluated as high-risk. In the event of a 100-year disaster at the Kyoto Plant, where the estimated scale of damage would be large, there could be a potential loss in sales of 9–13 billion yen over the medium to long term.

It is expected that demand for emergency power supplies will increase out of concern regarding intensification of natural disasters due to climate change.

It is expected that over the short to medium term, sales of HEVs and PHEVs will increase, but in the long term, as sales of EVs increase substantially and account for approximately 100% of sales in 2050, the battery market will change.

It is expected that in conjunction with the increased introduction of solar, wind, and other renewable energy generation, demand for batteries and peripheral systems and devices for electricity load leveling and the like will increase.

As a result of our estimate of the financial impact, setting certain conditions with reference to a scenario-based market, we concluded that sales could increase by 7–22 billion yen over the medium to long term due to an expansion of the market for energy storage systems for renewable energy in Japan.

It is expected that the development and spread of higher added value battery technologies (all-solid-state batteries, metal-air batteries, sulfur batteries, etc.) for transportation and electric power related applications will advance. In cases where the company can lead the development of new technologies, business opportunities will arise.

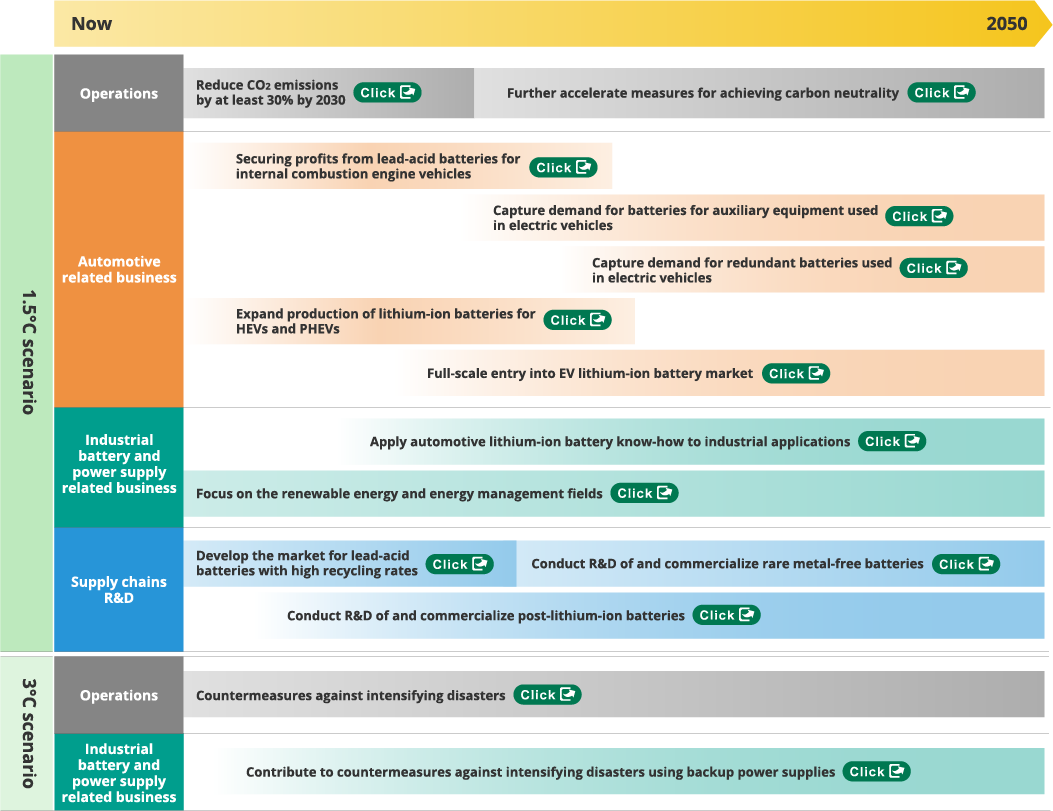

Direction of Business Strategies

Click the button for details.

*Scroll horizontally to view the entire page.

Implement measures for energy conservation and use of renewable energy

Further implement measures for energy conservation and procurement of renewable energy

Introduce differentiated products, strengthen our sales capabilities, and increase sales of high-value-added products with a focus on regions where internal combustion engine business remains such as ASEAN

Capture demand for 12 V lead-acid or lithium-ion batteries for auxiliary equipment used in electric vehicles as well (for new automobiles and for replacement)

Capture demand for lithium-ion batteries used for backup of self-driving vehicles

Production will increase, particularly for Japanese automakers, but will decline in the future

Invest development resources to enter the market for lithium-ion batteries used in EVs, which are used under demanding environments and must be highly reliably

Establish a lineup that includes both lead-acid batteries and lithium-ion batteries for industrial applications according to market needs

Strengthen operation, maintenance and inspection services, develop more price-competitive batteries, and introduce products and services aligned customer needs to capture demand for renewable energy

Capture demand for peak cutting, peak shifting, and other energy management services for business sites

Commercialize lead-acid batteries compatible with the needs of a recycling-oriented society

Promote R&D on and commercialize rare metal-free batteries such as sulfur cathode batteries

Promote R&D of all-solid-state batteries and put them into practical application, promote R&D of and commercialize Si anode batteries, Li metal anode batteries, and sulfur cathode batteries

Evaluate future risks including climate risks, implement countermeasures as necessary, and undertake BCP including supply chains

Focus on market expansion conditions and respond to needs

Metrics and Targets

【Sixth Mid-Term Management Plan (FY2023–2025)】

-

CO2 emissions

Reduce by at least 15% (compared to FY2018)

-

Water consumption

Reduce by at least 15% (compared to FY2018)

-

Percentage of environmentally considered products in total sales of all products

45% or more

-

Ratio of recycled lead used as lead raw materials in lead-acid batteries

70% or more

【Target for reduction of CO2 emissions (Scope 1 and 2)】

-

2030

Reduce by at least 30% (compared to FY2018)

2050

Carbon neutrality

【Internal Carbon Pricing (ICP)】

-

The price will be set at ¥15,000/t-CO2

Use as reference information when making investment decisions regarding energy-saving and renewable energy measures

-