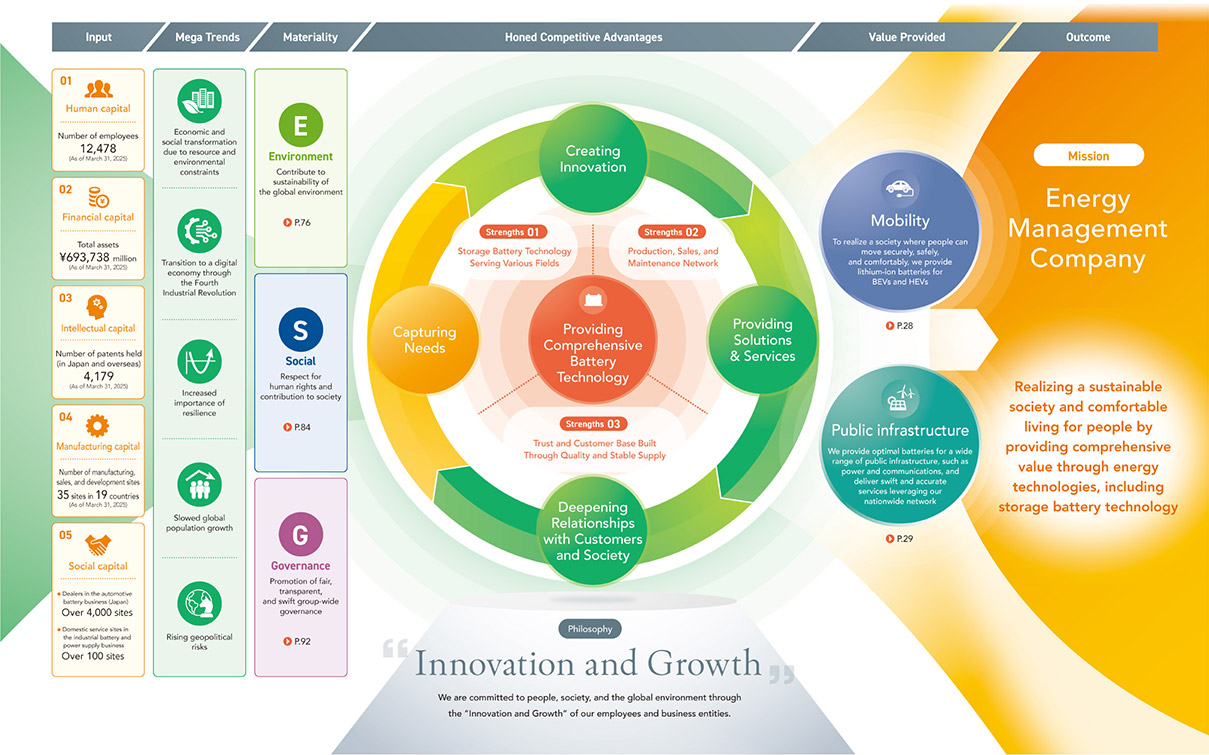

Philosophy

We are committed to people,

society, and the global

environment through

the “Innovation and Growth” of our

employees and business entities.

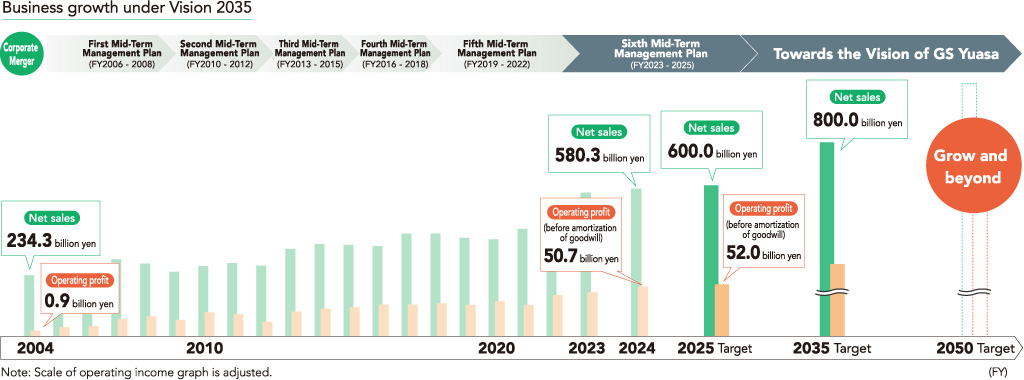

Vision2035/

Sixth Mid-Term

Management Plan

Vision of GS Yuasa

in 2035

Based on the “Four Re” formula, we strive for innovation in energy technology, address social challenges that arise from the growth of mobility and other public infrastructure, and seek to create comfortable living environments and play a vital part in the global effort toward sustainability.

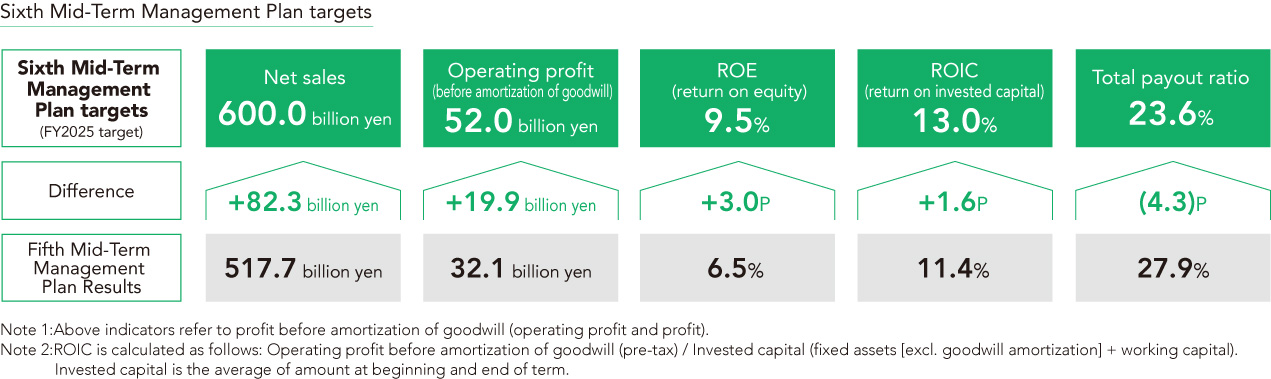

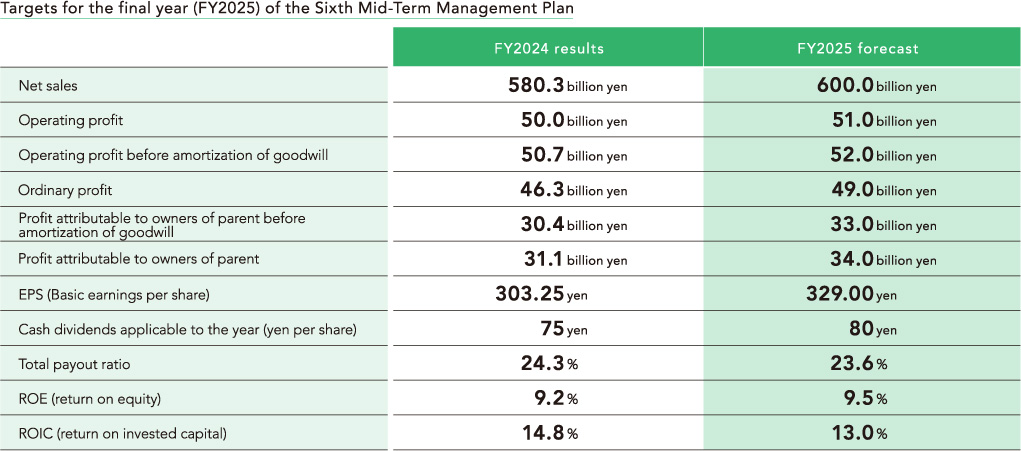

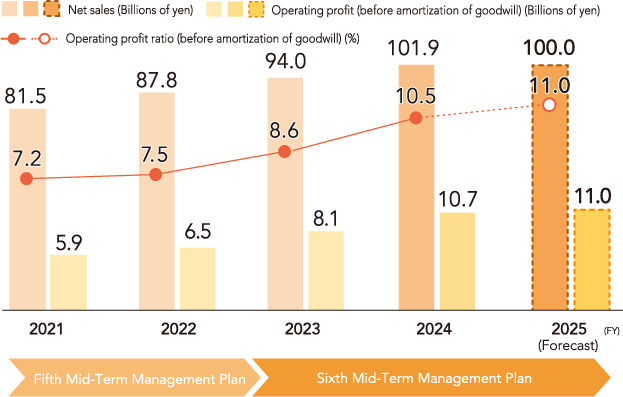

The Sixth Mid-Term Management Plan

– Key Initiatives

-

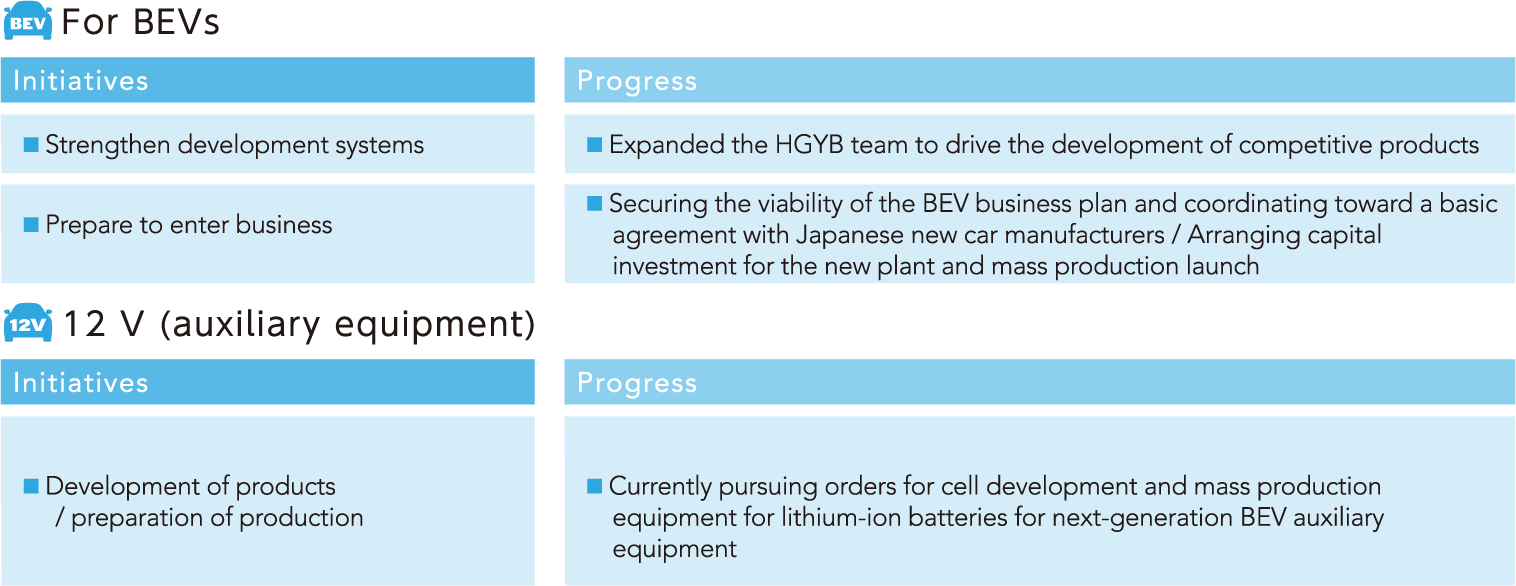

1

Development

of batteries

for BEVs

- Development of a high-capacity, high-output lithium-ion batteries by utilizing joint venture company with Honda

- Establishment of production and supply systems of batteries for BEVs to expand mobility and public infrastructure business

-

2

Reinforcement

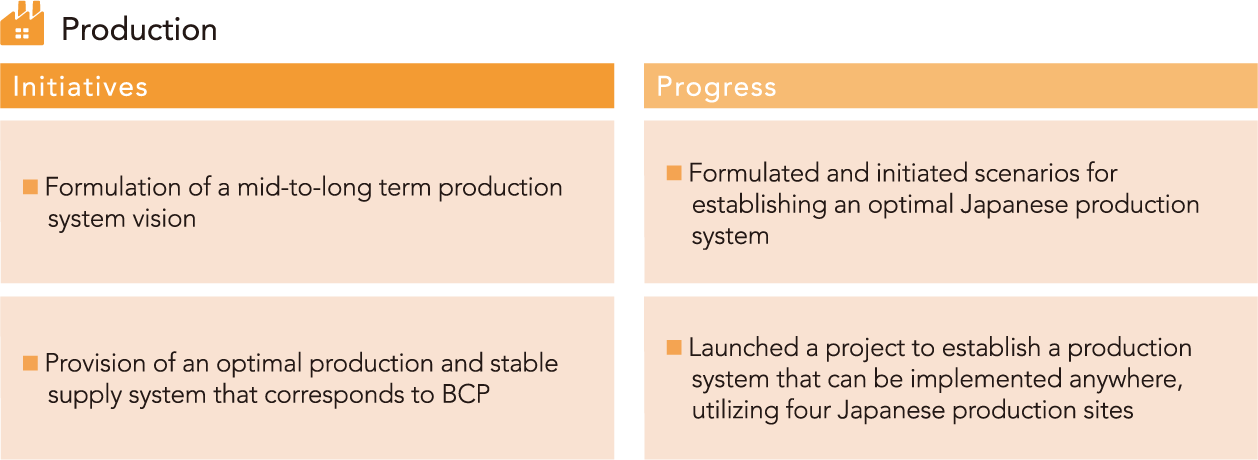

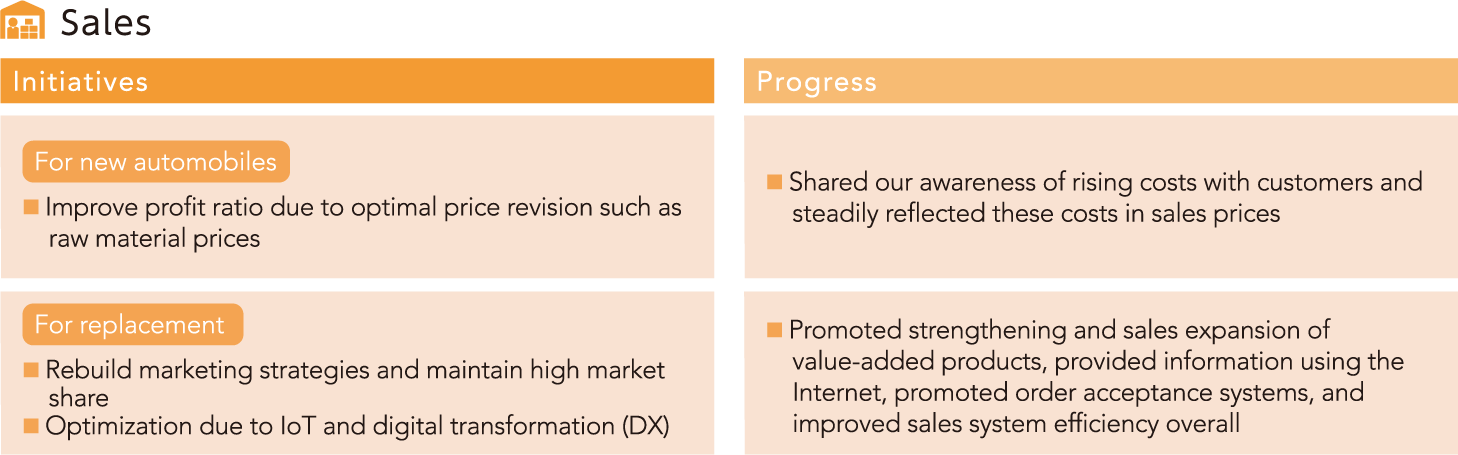

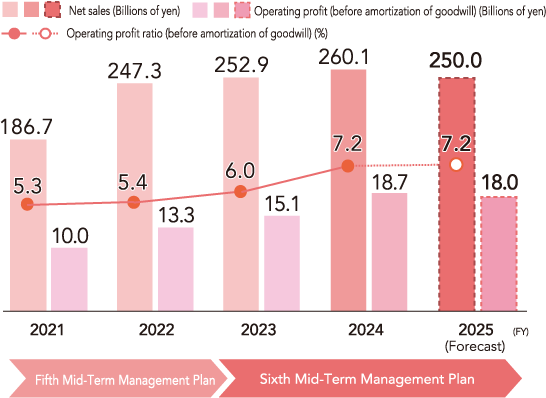

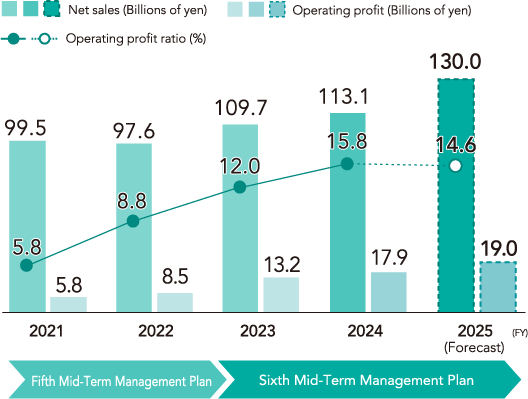

of earning capacity in existing business

- Thorough value-added creation and improvement in profitability

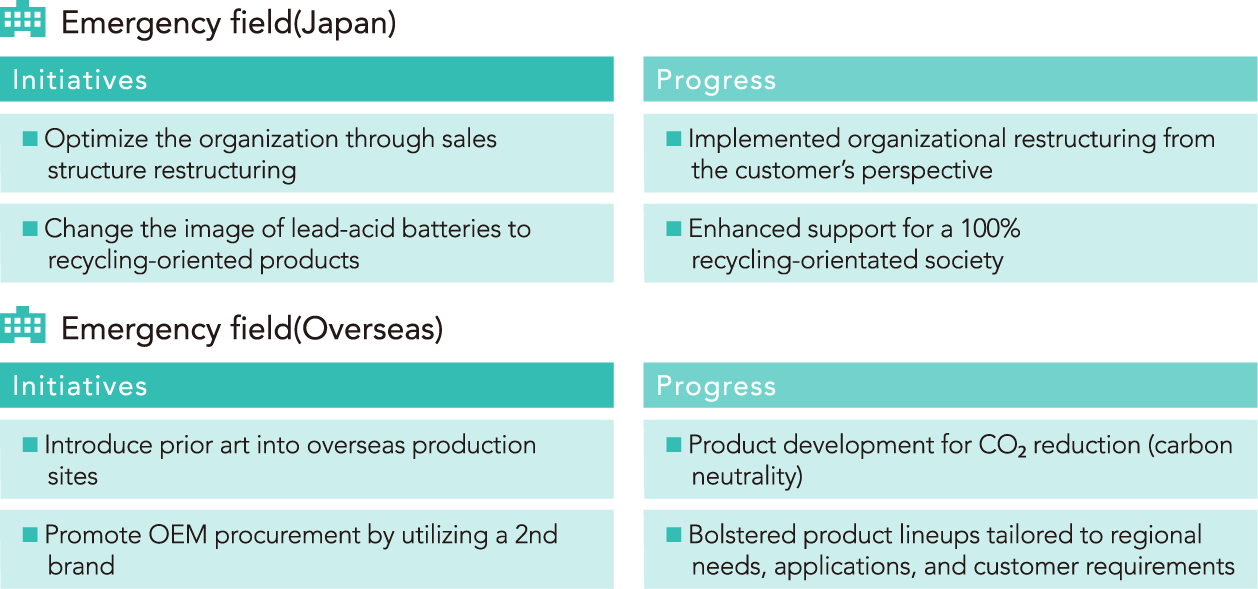

- Maximization of profits due to unparalleled superiority in Industrial Batteries and Power Supplies Business in Japan

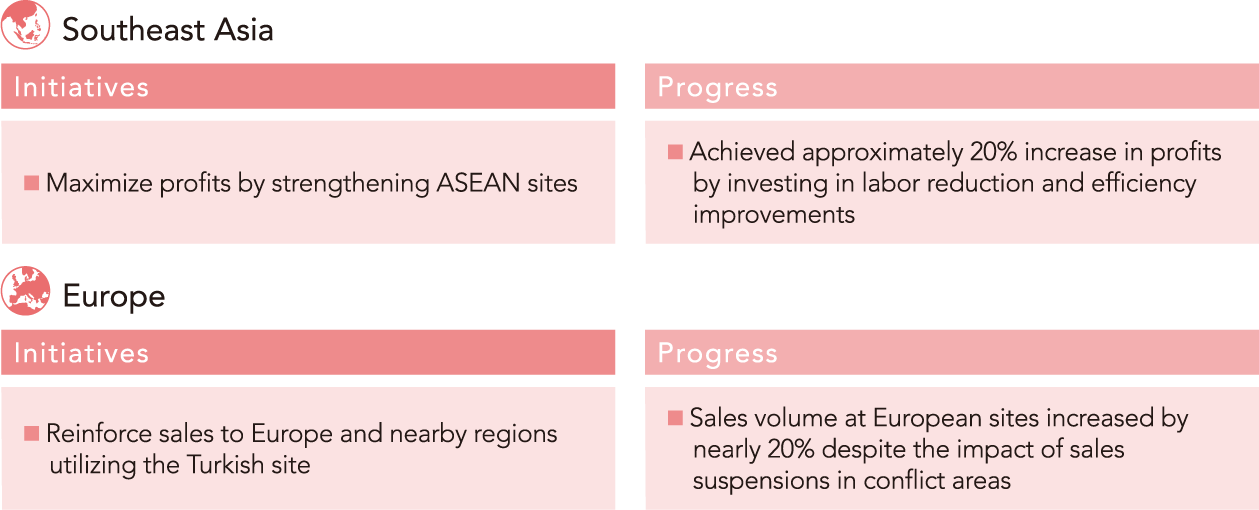

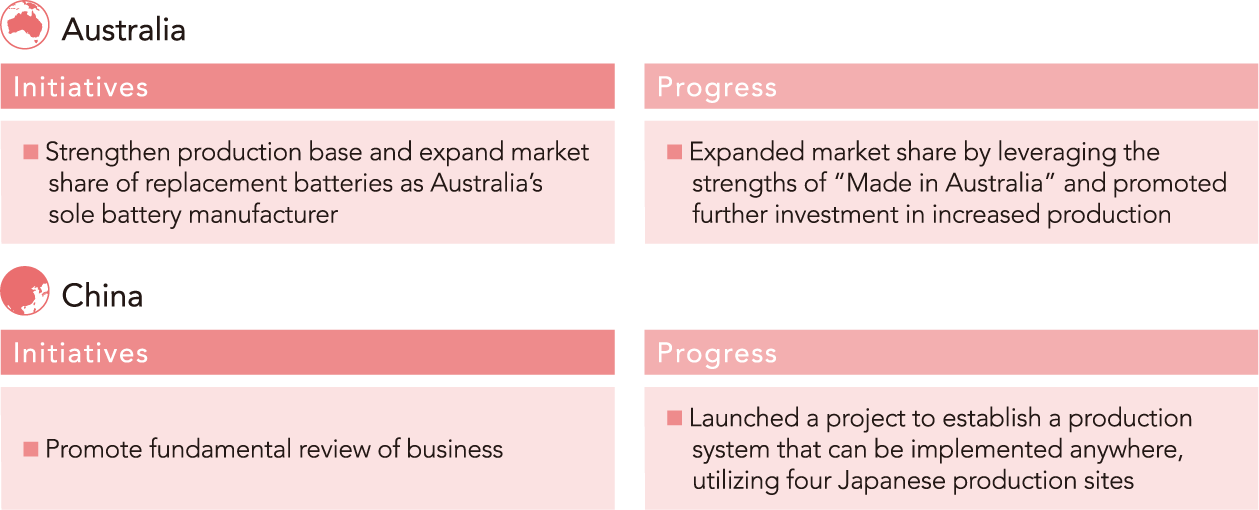

- Transformation of regional strategy, including review of business in China, maximization of profits by concentrating resources at main sites

-

3

DX /

new business

- DX promotion to enable business structure transformation

- Creation of new businesses that contribute to solving social issues

Features

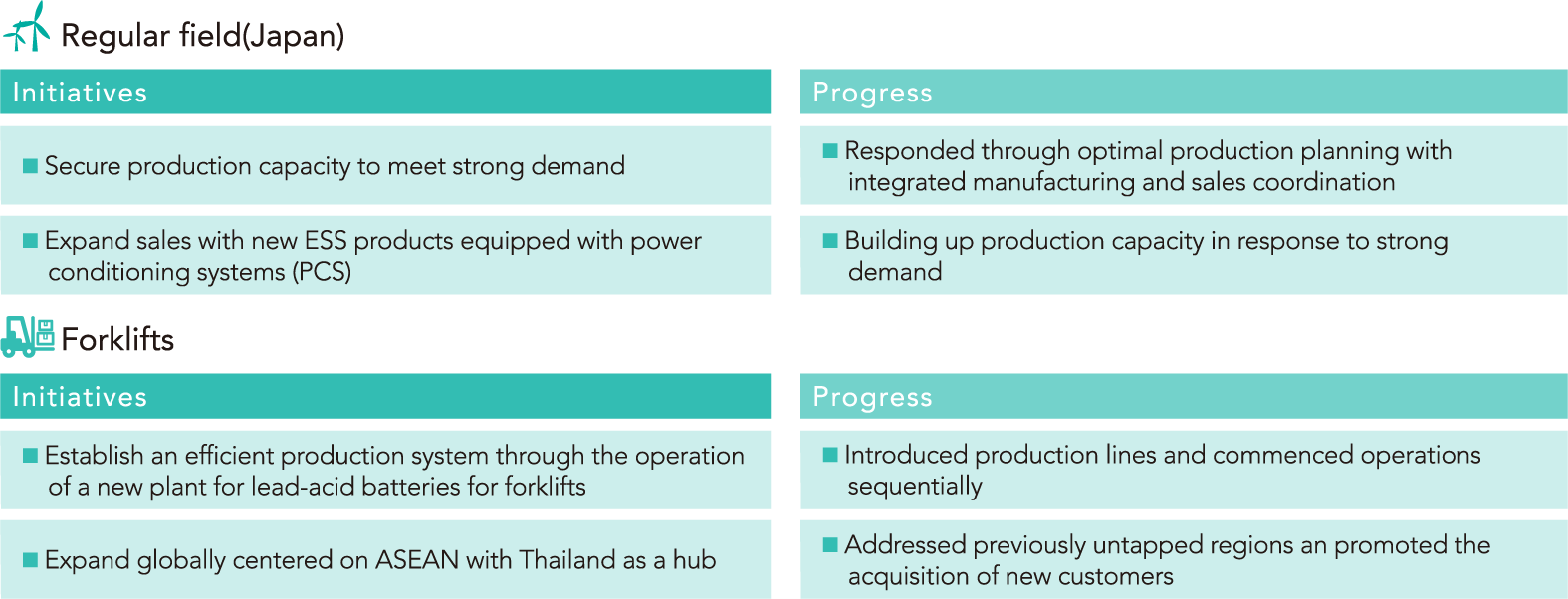

Initiatives in the Regular Field to Achieve Carbon Neutrality

This Feature describes our strengths and future direction for regular field applications of the industrial battery and power supply business—a growth driver—in response to growing demand for storage batteries driven by the expansion of renewable energy.

Initiatives to Strengthen the Foundation of Existing Business

This Feature describes our strengths and future direction for our existing businesses: automotive batteries, industrial batteries and power supplies, and specialized batteries.

Strategy by

Business Segment

Automotive Batteries

Message from the Business Unit Manager

Director, Business Unit

Manager of Automotive Batteries,

GS Yuasa International Ltd.

Takao Ohmae

Automotive Batteries (Japan)

Automotive Batteries (Overseas)

Industrial Batteries and Power Supplies

Message from the Business Unit Manager

Executive Officer, Business Unit Manager of Industrial Batteries and Power Supplies,

GS Yuasa International Ltd.

Yasuyuki Nakamura

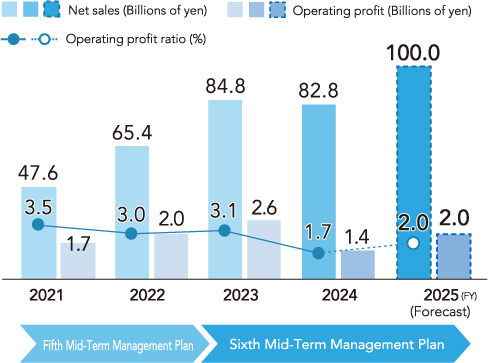

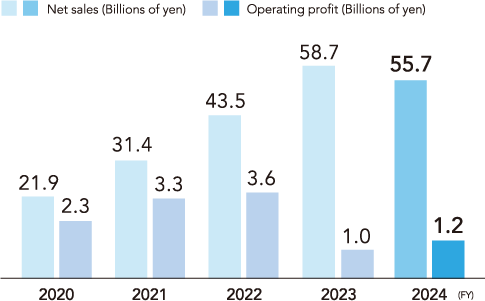

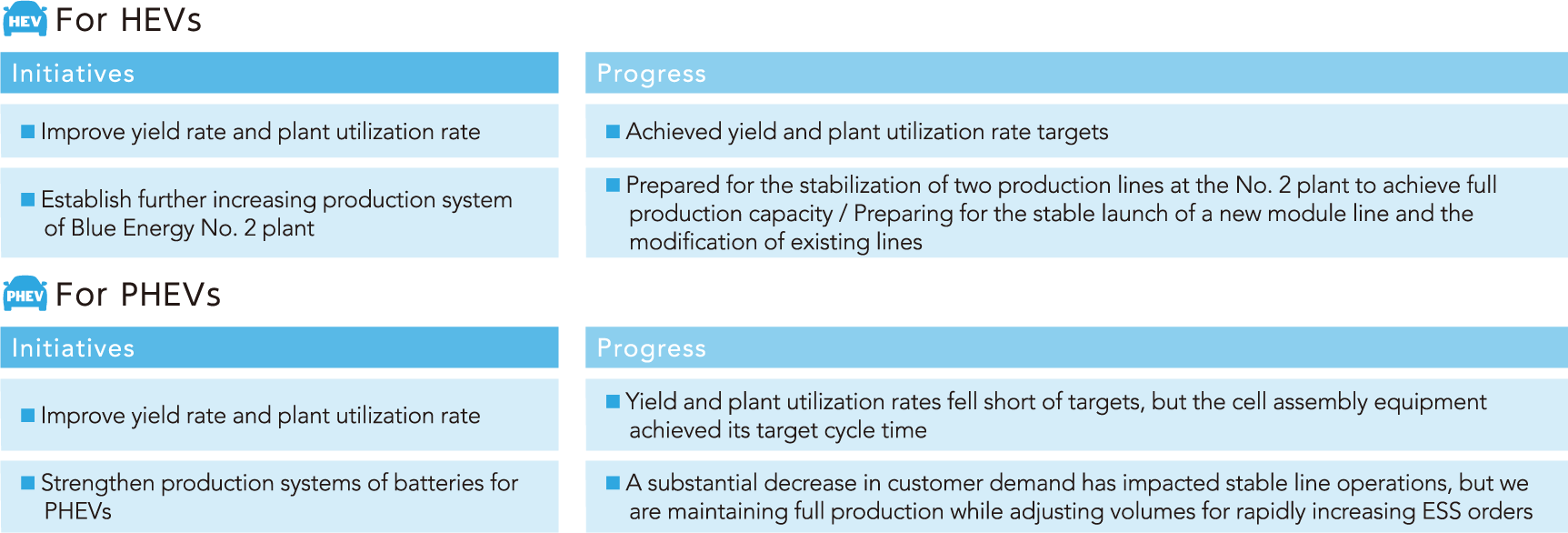

Automotive Lithium-ion Batteries

Message from the Business Unit Manager

Executive Officer, Business Unit Manager of Lithium-ion Batteries,

GS Yuasa International Ltd.

Toshiyuki Aoyama

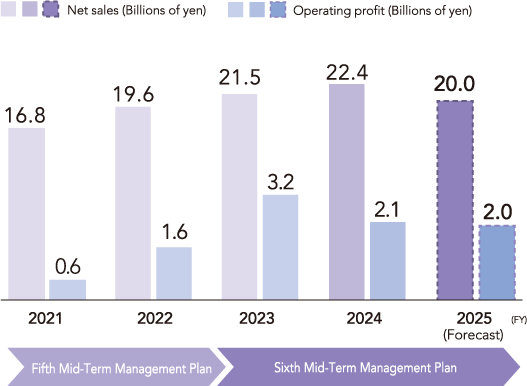

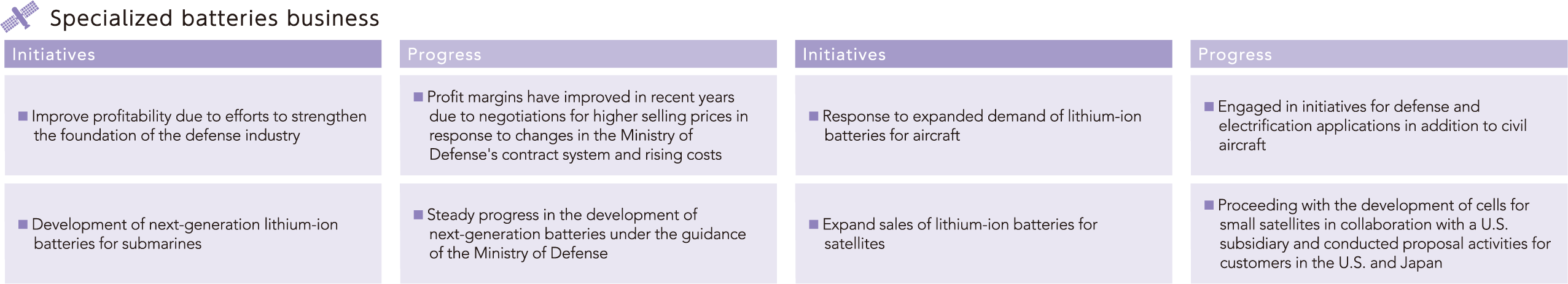

Specialized Batteries and Others

Message from the President of GS Yuasa Technology

President,

GS Yuasa Technology Ltd.

Yoshiaki Namikawa

ESG

Global Environmental Conservation

Global Environmental Conservation

Promotion of fair, transparent,

Promotion of fair, transparent,

and Sound business activities

PDF files

Download by section

Introduction

Section 01

GS Yuasa’s “Value Creation”

- Steady Evolution Generates Value

Section 02

“Company-Wide Strategy” for Value Creation

Section 03

“Business and Technical Strategies” for Value Creation

Section 04

“Foundations” of Value Creation

Section 05